Under current IDR guidelines, initiating parties may be limited in their ability to submit a subsequent Notice of Initiation involving the same party. This 90-calendar-day limitation is known as a “Cooling Off Period.”

However, it’s important to note that the rule only applies to claims that meet specific circumstances. Furthermore, its implementation can impact other IDR process deadlines that normally apply.

These nuances can result in confusion among providers and health plans. In an effort to add clarity to this cool off period, here are four key factors that both parties to the dispute should understand.

1. The Cooling Off Period only applies to specific claims.

For a new claim to be restricted by the Cooling Off Period it must meet three criteria.

- The claim must be between the same parties as the preceding claim.

- It must involve the same or similar items or services that were subject to the initial Notice of IDR Initiation.

- The payment (or notice of denial of payment) for the qualified IDR items or services would be made by the same group health plan or health insurance issuer or FEHB carrier;

- For fully-insured health plans, this means that qualified IDR items or services can be batched if payment is made by the same issuer even if the qualified IDR items or services relate to claims from different fully-insured group or individual health plan coverage offered by the issuer;

- For self-insured group health plans, qualified IDR items or services can be batched only if payment is made by the same plan, even if the same third-party administrator (TPA) administers multiple self-insured plans; o for FEHB carriers, qualified IDR items or services can be batched if payment is made by the same FEHB carrier, even if the qualified IDR items or services relate to claims from different FEHB plans offered by the carrier.

- A final payment determination must have been made on the initial Notice of IDR Initiation

If a claim differs in any one of the above criteria, the initiating party is free to submit a new claim without waiting for the 90-day period to conclude.

Example: If a patient received multiple services and one has been previously decided, a new claim could be initiated as long as it’s not related to the same or similar items or services.

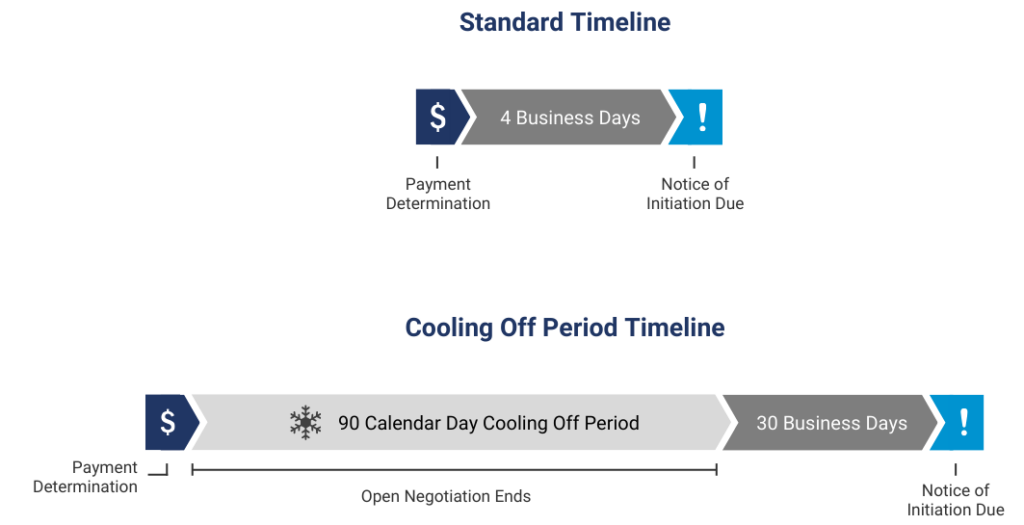

2. The Cooling Off Period is based on calendar days, not business days.

One of the most confusing aspects of navigating the IDR process is the fact that some deadlines rely on calendar days, while others count only business days.

The Cooling Off Period is a 90-CALENDAR-DAY window

3. The Cooling Off Period begins immediately following payment determination.

The 90-calendar-days start the first day after payment determination is made by the IDR Entity. In addition, the Cooling off Period applies even if a different IDR Entity will be managing the new dispute.

4. The Notice of IDR Initiation deadline can change due to an active Cooling Off Period.

Typically, an initiating party must submit a Notice of IDR Initiation within 4 business days following the end of an open negotiation period. However, this standard 4-business-day deadline changes when a claim is restricted by the Cooling Off Period and the open negotiation period ends during that window.

In these cases, the Notice of Initiation for same or similar items exiting the open negotiation period during an applicable Cooling Off Period are due within 30 business days of the end of the Cooling Off Period.

Comment below: Was this helpful? What other questions can we help answer?

As always, feel free to contact our team via chat, email, or call, and our

IDRE service team can answer your immediate questions.

Legal Disclaimer

The information contained in this content piece is for general informational purposes only. While we strive to ensure the accuracy and completeness of the information presented, we make no representations or warranties of any kind, express or implied, about the accuracy, reliability, suitability, or availability with respect to the content or the information, products, services, or related graphics contained in the content piece for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The content of this page is subject to change without notice. The information provided in this document does not constitute legal or other professional advice, and is non-binding upon FHAS and any federal government agencies.